Get ready to witness eye-watering amounts of money spent in less time than it takes for you to refresh Twitter. It’s spring auction week in New York, when Christie’s, Sotheby’s, and Phillips hold their marathon sales of Impressionist, Modern, postwar, and contemporary art.

The eventual results of these sales may or may not differentiate, but consignments and pre-sale projections provide a valuable look into how consignors and top professionals in the auction sector read the market at this critical moment in the annual calendar.

The analytical boundaries:

- The charts below cover only pre-sale data. They do not include sales results.

- The data covers only the regularly scheduled fine art auctions held in New York in May by Christie’s, Sotheby’s, and/or Phillips. For Christie’s and Sotheby’s, the sample includes Impressionist and Modern evening and day sales, plus postwar and contemporary evening and day sales. For Phillips, it includes 20th-century and contemporary evening and day sales.

- No single-collection or themed sales appear in the analysis.

- All estimate values are denominated in US dollars.

- All data is current as of May 9, 2018 and comes courtesy of the artnet price database and artnet analytics report.

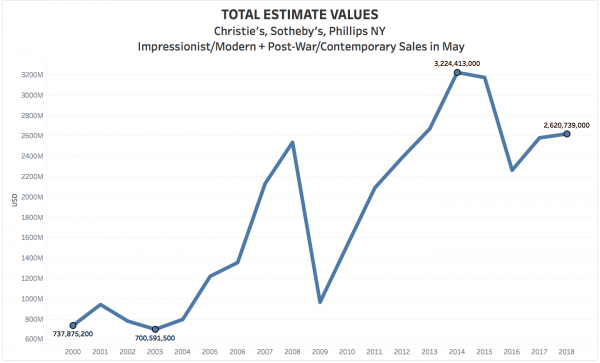

1. Overall, estimated values have nearly quadrupled in the last 19 years. (In other words, art is getting a lot more expensive.)

The chart below shows the total value of pre-sale estimates for the main sales in May dating back to 2000.They’re nearly four times as high as they were 19 years ago.

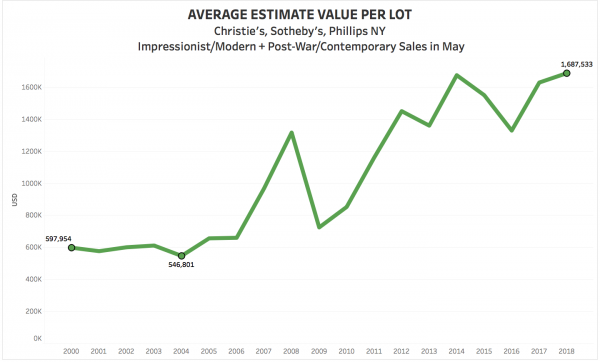

This picture represents a dramatic expansion of the market in less than two decades. But it also begs an obvious follow-up question: What’s been a bigger drive of this growth, the number of artworks coming to auction, or the price per work?

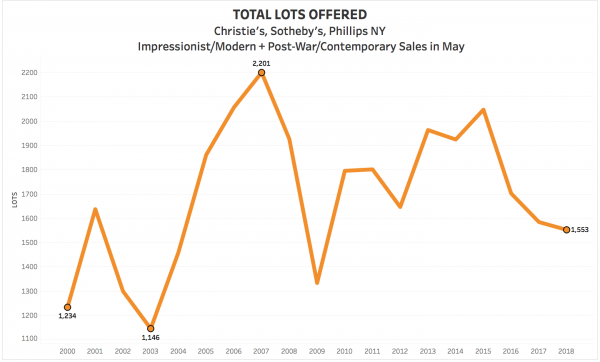

Here’s a look at the auction volume, meaning the number of lots offered, in the same sales over the same period. (Worth noting: Christie’s did not hold any postwar and contemporary auctions in May 2000, so their re-entry in 2001 creates an automatic one-year jump in practically every chart we’ll review here.)

Overall, we reached peak auction volume for this sales cycle in 2007, when the three houses combined to offer about 2,200 lots. That number was about 78 percent higher than in 2000.

In comparison, this May’s total of 1,553 lots qualifies as an increase of only about 300 artworks, or roughly 25 percent, over our starting point 18 seasons ago.

So if we’ve seen a nearly 400-percent rise in pre-sale estimate value from a roughly 25-percent rise in the number of offered works, it doesn’t require a bolt of divine inspiration to conclude that artwork at auction has been getting significantly more expensive.

The data also points to some more surprising conclusions, as well.

2. Postwar and Contemporary lead.

It is an article of faith that the art market’s growth this millennium has owed largely to the explosion of interest in postwar and contemporary work.

The 110.5 million dollars (nearly 750 million yuan) paid for a painting by the black New York artist Jean-Michel Basquiat in May 2017 was no flash in the pan, according to another art news giant, Artprice, the world‘s leading online art price database.

The stratospheric price illustrates a profound change in market attitudes », it said in its half-year report, showing that collectors are now perfectly willing to pay equivalent sums for contemporary and historical masterpieces alike. The new era of prosperity that the art market has entered is, for the first time in history, driven by contemporary art. This represents a historic development in art history and an undeniable indicator of art market confidence in living artists.

Demand for contemporary work was traditionally a soft part of the art market, but its share has risen five-fold since 2000.

Overall sales grew nine percent in the six months to the end of June. This new dynamic is a result of a gradual transformation of the art market, Artprice index’s founder Thierry Ehrmann said. Since 2000 collectors have shown a growing interest in works created during the second half of the 20th century, the early 21st century and works by living artists.

He said part of the reason for the surge in contemporary art was that contemporary art has become an economic marker which is expected to grow exponentially. The rise in prices for work by living artists helped drive a 5.3-percent increase across the whole market, dragging it out of two years of decline.

*extracted from artnet analytics report and artprice.com